How does the crypto price increase – Ultimate guide 2023

Have you got an inkling about which crypto is the next on the rise? In this post, we’ll talk about the way in which

cryptocurrency price increase in value and lead you to investigate a few examination strategies.

Cryptocurrencies have often had the

blockchain technology as their ground and thus initiated a shift in our thinking around and approach to using money itself. And just as importantly, cryptocurrencies operate on decentralized networks—unlike fiat currencies issued by central banks—giving individuals control over their own money transfer and safety. But there is still the problem of what gives an abstract thing — something that does not exist in the physical world — its value if there’s nothing backing it up? Why are bitcoin prices rising? Why do crypto markets fluctuate up and down? In this guide we’ll explain How does Bitcoin gain value.

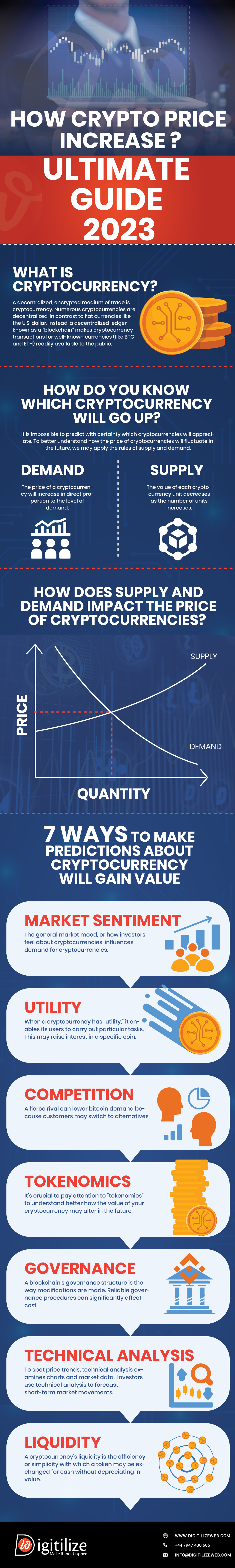

What is cryptocurrency?

In simple terms, a cryptocurrency is a digital asset designed for trade, using blockchain technology to record online transactions and ownership history. They’re like virtual tokens, valuable due to their internal system for storing financial data. The most lucrative use of cryptocurrencies is for payments, as they’re decentralized, with minimal processing costs and less government regulation. This makes them transferable, resistant to inflation, and offers transparent transaction history.

What kinds of cryptocurrencies are there?

Bitcoin, the original cryptocurrency, has a capped 21 million f

Bitcoin value. This limitation makes it an option for wealth storage, similar to investing in gold. A network of miners maintains the Bitcoin blockchain by performing complex calculations and receiving newly created Bitcoins as rewards. Bitcoin’s transaction system has a monetary value due to Proof-of-Work.

Cryptocurrency coins are physical representations of money, created through the mining process on the blockchain. Tokens, unlike physical counterparts, have no material equivalent. They are gaining popularity for making payments in dApps, getting fee discounts, and covering voting expenses, similar to the decoupling of fiat currency from the gold standard.

Alternative cryptocurrencies, or altcoins, stem from significant alterations to Bitcoin, often through a Bitcoin fork. Altcoins come in various forms, and their blockchains exhibit key differences compared to Bitcoin. Some altcoins feature an unlimited supply, altering their usage dynamics. Accelerated mining and transactions result in faster blockchain performance in some cryptocurrencies. Moreover, the method used for transaction verification can differ between various cryptocurrencies. For instance, several cryptocurrencies utilise the Proof-of-Stake consensus technique, replacing miners with validators in contrast to Proof-of-Work systems.

Proof-of-Stake mining is more energy-efficient than

Proof-of-Work mining due to its lower resource requirements.

7 ways to make a prediction about the cryptocurrency will gain value

The general market mood, or the way in which investors feel about cryptocurrencies in general, influences demand for cryptocurrencies. Prices may increase if market mood improves. As an illustration, Coinbase’s shares began trading publicly on the same day that Bitcoin reached its all-time high. Investors felt more at ease investing in Bitcoin and other digital assets because of the perception that the Coinbase IPO was a significant step forward for the cryptocurrency sector.

Market demand and acceptance significantly impact a crypto price increase and its growth.

Utility of cryptocurrencies gain more value when they have practical applications, like supporting

decentralized networks or enabling cross-border transactions. As acceptance grows, a cryptocurrency’s value proposition strengthens due to the network effect. When retailers and businesses begin accepting it as payment, cryptocurrency becomes more useful and appealing to customers. The value of a cryptocurrency isn’t solely speculative; it depends on its real-world functionality and problem-solving abilities in various sectors.

The token environment in the Bitcoin space is quite diversified, with new initiatives and tokens constantly appearing. Although the hurdles to entry are generally low for new competitors in cryptocurrency, building a user network is essential for a cryptocurrency to succeed. Applications built on the blockchain that are useful can quickly gain customers, especially if they solve the drawbacks of competitors’ products. The value of existing rivals is diverted when a new challenger acquires traction, which lowers the price of the incumbent token as the growing value of the new challenger’s token gains notoriety.

It’s crucial to pay attention to “tokenomics” if you want to better understand how the value of your cryptocurrency may alter in the future. This is a reference to the monetary policy of the cryptocurrency project, or how the project manages supply and demand. Tokenomics is approached differently by various initiatives. For instance, Ethereum “burns” a portion of transaction fees, but Bitcoin has a hard ceiling of 21 million coins. Other cryptocurrency projects feature a “vesting schedule”; for instance, early investors might not be allowed to sell their shares until after a year has passed.

A cryptocurrency governance structure is a way to introduce modifications. Pricing can be greatly influenced by dependable governance procedures. We may use the 2016 DAO attack as an illustration of how governance might affect pricing. In circulation at the time, 14% of all Ether was owned by the protocol. As a result, ETH holders decided to fork the blockchain in order to restore its previous history before the attack. Despite the possibility that the DAO breach would have been disastrous for Ethereum, the blockchain continued to draw new users throughout the years. This governance choice most likely contributed to user trust development.

Some investors estimate the short-term price of a cryptocurrency using technical analysis. To spot price trends, technical analysis examines charts and market data. Technical analysis does, of course, have its limits. The realized cap lessens the impact of inactive or lost currencies by valuing coins according to their practical existence in the chain’s economy. Each time a coin that was previously traded at a considerably lower price is used, it grows by a constant volume. Some detractors stress that historical patterns aren’t always a good predictor of future success.

Cryptocurrency market liquidity advantages describes the ease of buying or selling assets without impacting their price. High liquidity offers numerous advantages: it promotes price stability, attracts institutional investors, simplifies price discovery, reduces transaction costs, and enhances overall market confidence and crypto price increase. Robust cryptocurrency liquidity results in fewer price swings, appealing to institutions and stability-seeking investors. As liquidity increases, it may drive wider adoption, fostering increased trust and stability.

Conclusion

Like any money, the level of community participation determines how valuable cryptocurrencies are. A crypto price increase if there is a greater demand than there is for it. When a cryptocurrency is helpful, demand increases because more people want to hold it. People don’t want to sell it because they want to use it. As a result, the value rises since there is greater demand than there is supply.

If you’d want to read more updates like this, you must visit LinkedIn.

Frequently Asked Questions

Factors such as market demand, technological advancements, regulatory support, and media coverage can vary widely among cryptocurrencies, influencing their individual price movements.

Yes, cryptocurrencies are known for their volatility, so prices can decline sharply due to adverse news, regulatory changes, market corrections, or profit-taking by investors.

Economic instability, inflation, and currency devaluation can lead investors to seek alternative investments like cryptocurrencies, driving up prices.

Herd mentality occurs when investors follow the actions of others. If many investors start buying a cryptocurrency, others may follow, fearing they will miss out on gains, which can drive prices higher.

Yes, the introduction of stringent regulations can create uncertainty and fear among investors, leading to sell-offs and decreased prices.

Social media and influencers can significantly impact public perception and investor behavior. Positive endorsements or mentions can lead to price increases, while negative commentary can have the opposite effect.